arizona solar tax credit 2019

Solar Federal Tax Credit. The Renewable Energy tax credit ARS.

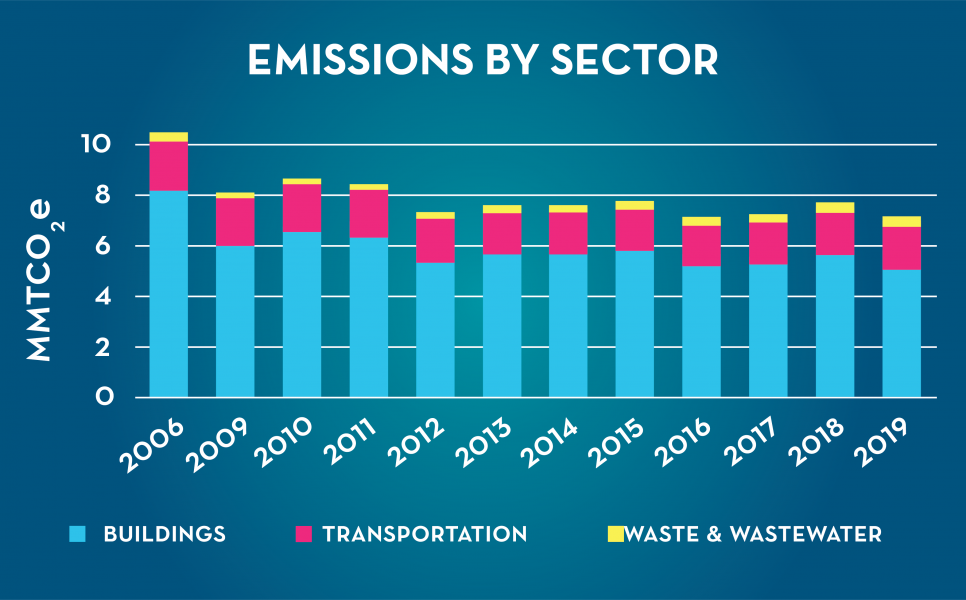

Greenhouse Gas Inventories Ddoe

See details about the federal personal tax credit here.

. Arizona State Tax Credit. The state of Arizona offers residential customers a 25 or 1000 maximum credit per residence of solar installation. June 6 2019 1029 AM.

Favorable laws rebates property and sales tax. But in order to qualify for that. To claim this credit you must also.

Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. Was the federal solar tax credit extended. Arizona solar tax credit.

It was originally going to drop to 22 in. Get Pricing Calculate Savings. Individuals in Arizona receive a tax credit for 25 of.

Arizona is a leading state in the national solar power and renewable energy initiative. Arizona Personal Tax Credit. Find Top Rated Solar Programs in Your Area.

Yes the solar investment tax credit. Find Top Rated Solar Programs in Your Area. Was the federal solar tax credit extended.

30 for systems placed in service by 12312019 Expired 26 for systems placed in service after 12312019 and before. The credit amount allowed against the taxpayers personal income tax is. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

41-1511 was established by the Arizona. An Arizona state tax credit up to 100000 A 26 federal solar tax credit. There is no maximum amount that can be.

This tax credit is good through 2022. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. Installation of the PV system must have been between January 1 2006 and December 31 2019.

Get Pricing Calculate Savings. Your Name as shown on Form 140 140PY or 140X Your Social Security Number Spouses Name as shown on Form 140 140PY or 140X if a joint return Spouses Social Security Number Part. Renewable Energy Production Tax Credit.

Ad Enter Your Zip Code - Get Qualified Instantly. Since 1995 the state of Arizona has offered. Currently the credit amount is as follows.

Ad Free Arizona Solar Quotes. Yes the solar investment tax credit was extended at the 26 rate for an additional 2 years. It was originally going to drop to 22 in.

For people interested in saving money and diminishing their carbon footprint installing solar panels are now a much more affordable and realistic option. That means that for solar electric systems put into service between Jan 1 2009 and Dec 31 2019 you will be able to get back 30 of the total cost of the system with no cap for. Other solar tax benefits throughout Arizona.

Ad Enter Your Zip Code - Get Qualified Instantly. Arizona solar tax credit. The Renewable Energy Tax Incentive Program is not available beginning on or after January 1 2021.

Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. Check Rebates Incentives. Arizonians who install solar panels on their property have access to.

The Federal solar tax credit allows homeowners to reduce 26 of the total costs related to their solar installation from what they owe on their federal taxes due. Known as the Residential Solar and Wind Energy Systems Tax Credit this incentive gives you a tax credit of 25 percent for your new solar energy system. The credit is allowed against the.

Arizona Residential Solar and Wind Energy Systems Tax Credit. Arizona Renewable and Solar Energy Incentives. 1 Best answer.

This is claimed on Arizona Form 310 Credit for Solar Energy Devices. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

The credit is claimed in the year of. This incentive is an Arizona personal tax credit. Check Rebates Incentives.

The State Of Solar 350 Brooklyn

The Federal Solar Tax Credit Has Been Extended Through 2023 Ecohouse Solar Llc

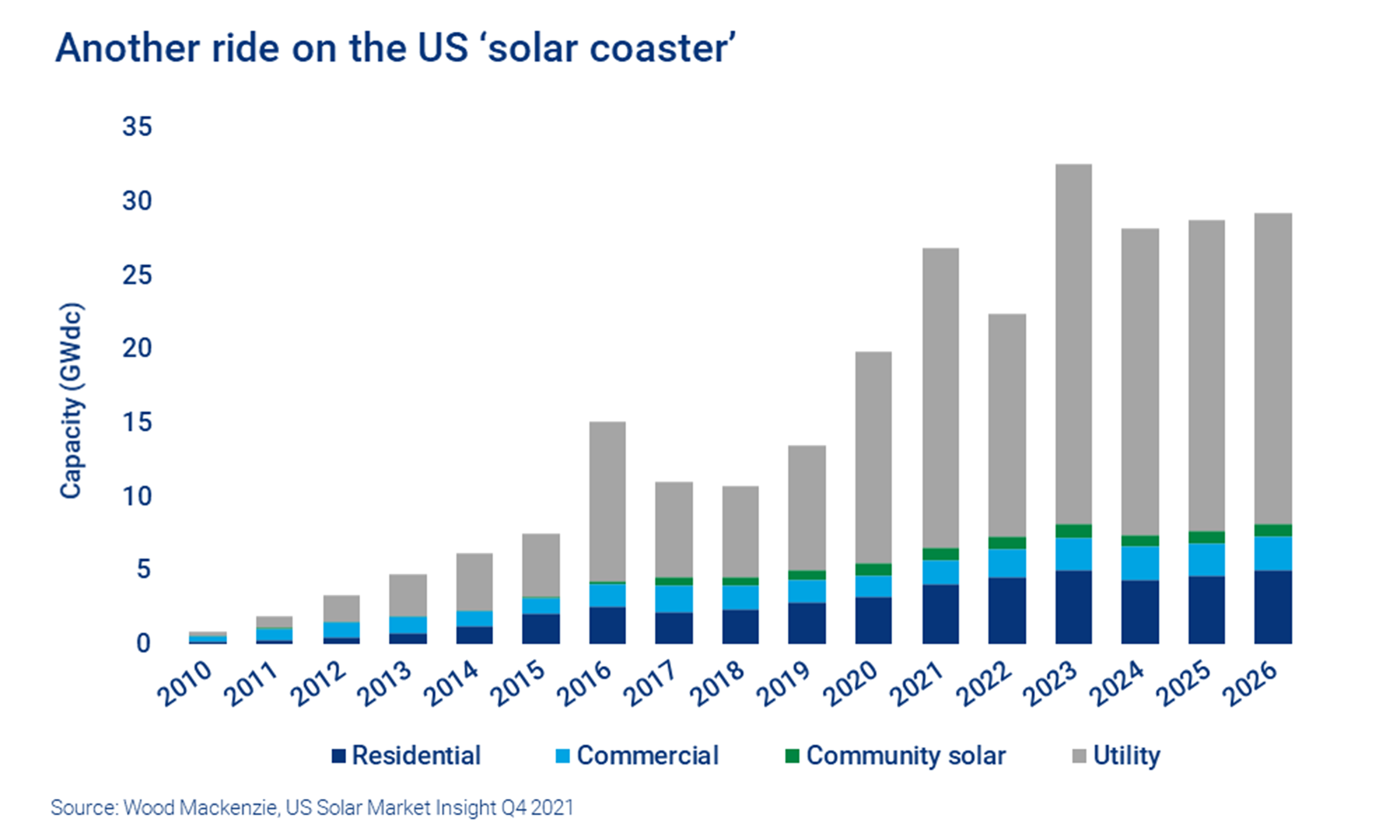

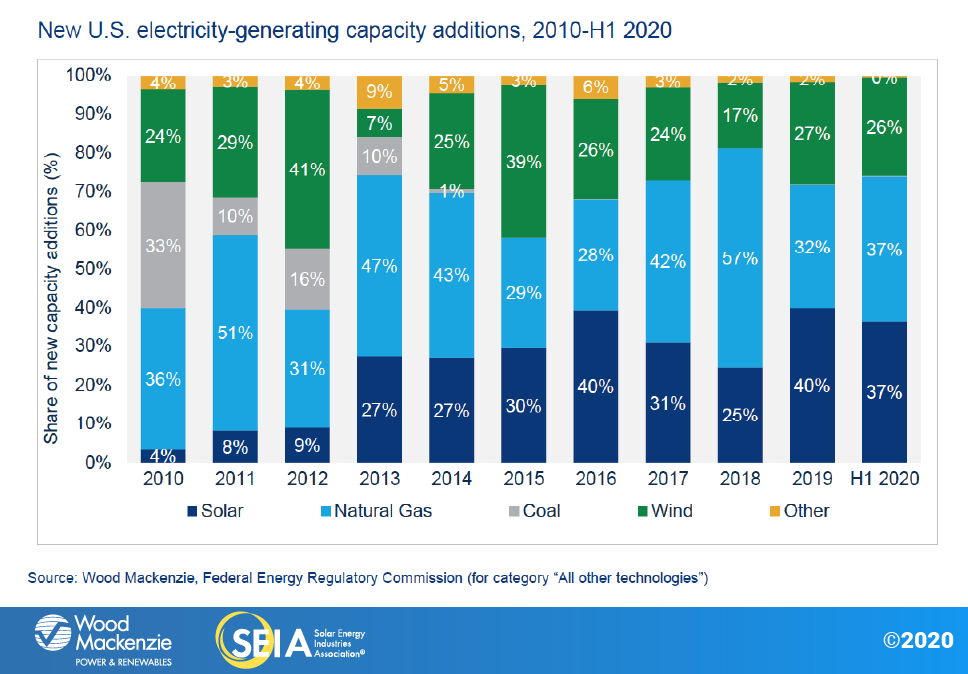

Redefining The Us Solar Coaster Wood Mackenzie

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Best States For Solar In 2019 Growth And Payback Energysage

Energy Design Rating Energy Consulting Energy Energy Services

Solar Tax Credit In 2021 Southface Solar Electric Az

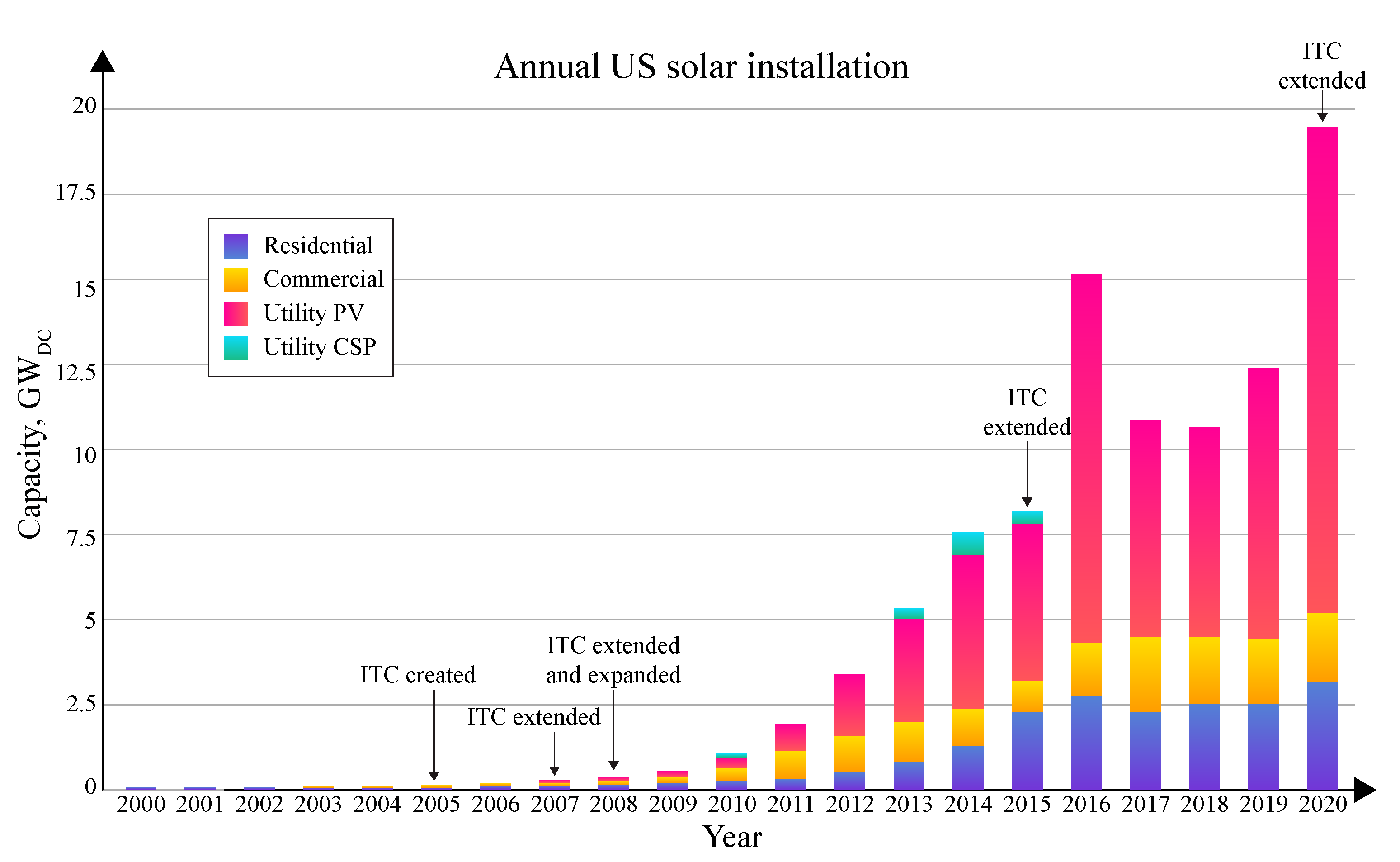

Solar Market Insight Report 2020 Q3 Seia

Will Solar Panels Get Cheaper Updated For 2022

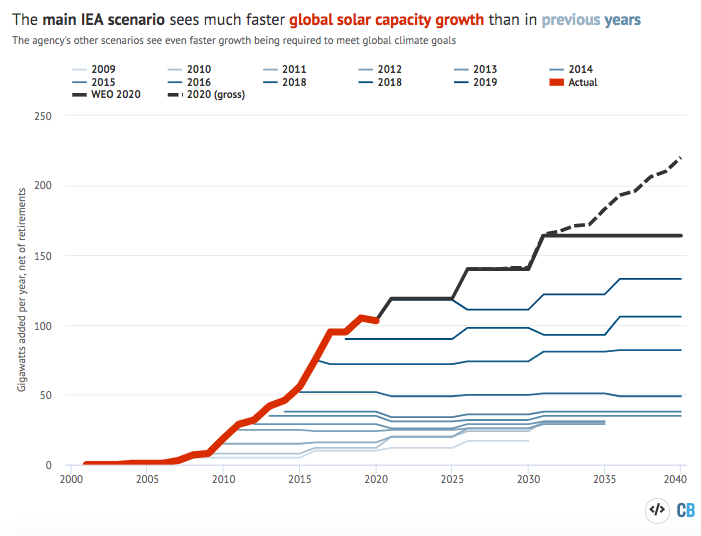

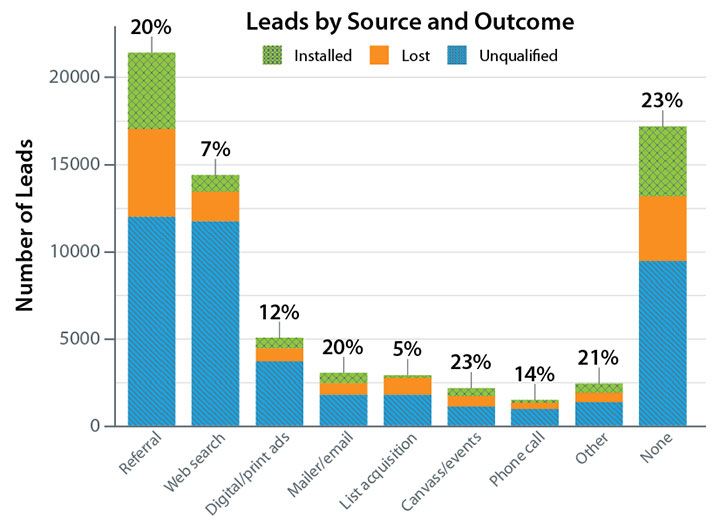

Energies Free Full Text Solar Energy In The United States Development Challenges And Future Prospects Html

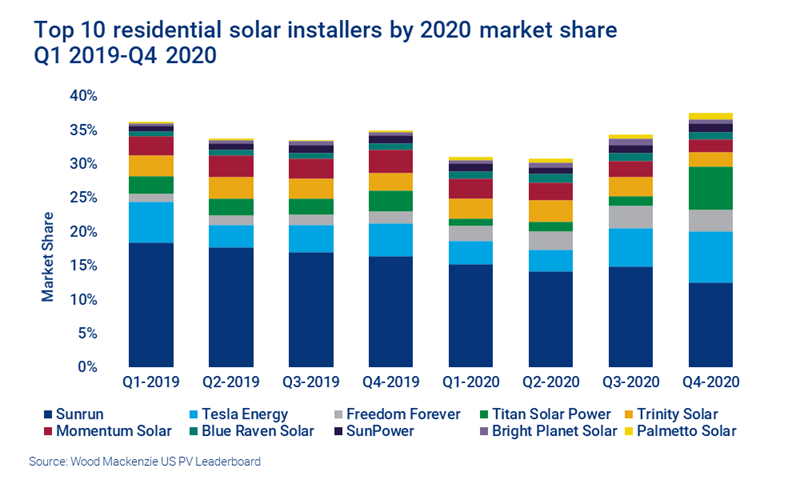

Sunrun Retains Its Title As Largest Residential Solar Installer In The Us Wood Mackenzie

Everything You Need To Know About The Solar Tax Credit Palmetto

Are Solar Panels Worth It In Arizona Yes Ae Llc

Solar Is Now Cheapest Electricity In History Confirms Iea

Where And When To See The May 20 Solar Eclipse Eclipse Photos Solar Eclipses Solar Eclipse

The Extended 26 Solar Tax Credit Critical Factors To Know

Fun Free Things To Do Near Me With Kids Archives United States Map Usa Map Territories Of The United States

Solar Energy Evolution And Diffusion Studies Webinars Solar Market Research And Analysis Nrel